Customer Value Analysis

Customers make their decision to buy a product or service based on their perception of value. This is the underlying assumption behind the measurement of Customer Value Added (CVA). If customers can obtain greater value elsewhere, they will. Studies have indicated that the value of a company’s product or service, as perceived by its customers, is the single best predictor of future changes in that company’s market share.

More Than Customer Satisfaction…

Customer satisfaction with a product or service results from providing superior value - the right combination of quality and price. In other words, it’s the customer’s answer to, “Was it worth what you paid for?”. Customer satisfaction is important, but evidence shows that a “satisfied” customer will repurchase from someone else, especially if they can find a better value.

The CVA Analysis produces more than a simple measure of customer satisfaction. It results in a more meaningful and more important measure, one that compares a company to its competitors in terms of the value provided by each. The CVA Analysis answers a critical question for many companies “How satisfied are our customers with our products and services compared to our competitors’ products and services?”

The CVA measure is the ratio of how customers rate a company on “worth what paid for” relative to how they rate its competitors on the same. Using WWPF as an abbreviation for “worth what paid for,” CVA can be better understood using the following ratio:

Several studies have shown conclusively that when a company’s product or service is perceived as providing more added value (price and quality) than its competitors, it will gain market share. Should the opposite be true, the company will lose market share. In terms of the ratio above, the following rules of thumb apply:

If CVA < 1, a company is likely to lose market share.

If CVA = 1, a company likely to neither gain nor lose market share.

If CVA > 1, a company likely to gain market share.

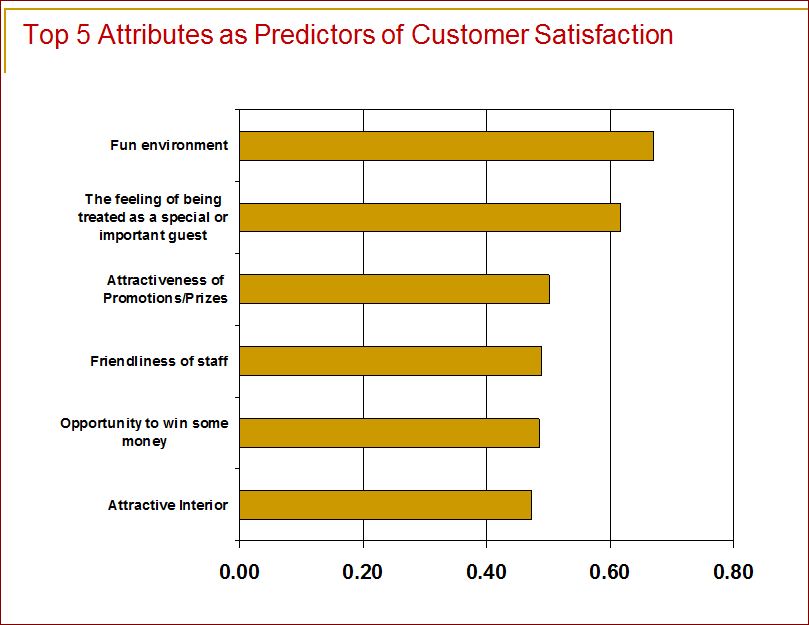

The CVA ratio is not a variable which is manipulated directly however. That is, a company cannot merely say, “let’s improve our customer’s perception of our WWPF.” Instead, a company must first identify the attributes of its product or service that are most important in the minds of its customers. Once these attributes are identified, a company can focus its improvement efforts on the attributes that drive its customers’ perceptions of “worth what paid for.”

The greatest benefit of the CVA Analysis is that it helps a company identify the specific attributes of its products and services that drive its customer’s perception of value. Measuring CVA is a powerful way to track an organization’s performance on the attributes that customers most value. This data enables the company to respond proactively and protect and grow its market share position.

The diagram at left is an example of a Customer Attribute Tree, a key component of the CVA Analysis. Created using applied factor analysis and multiple regression analysis, it shows how a company might identify the attributes most important to customers, and then identify, controllable metrics and scorecards for managing results over time.

A second component output of the CVA is the Customer Value Map. By including the customers of a company’s competitors in a CVA survey, a company can see a graphic representation of where it stands in the competitive marketplace. Note the placement of the “fair value line.” Studies have shown that companies on the negative side of this line are destined to lose market share, while companies on the positive side of the line are likely to maintain or gain market share.

How would I use the CVA?

Our CVA products and services are designed to support senior-level managers in the areas of strategy development, company growth and market share initiatives, organization design, and reengineering. If you are working on strategic initiatives that require information about your company’s position in the market place, or the factors that drive company growth, you will find the CVA offering to be an invaluable tool.